Ontario’s Liberal Government promised to cut car insurance rates prior to the last election. On June 1, 2016 rates did indeed go down, but at a significant cost to accident victims. Instead of asking insurance companies to cut their own costs in order to reduce rates, the Government and insurance industry decided to drastically cut benefits for some of the most seriously injured people in this Province.

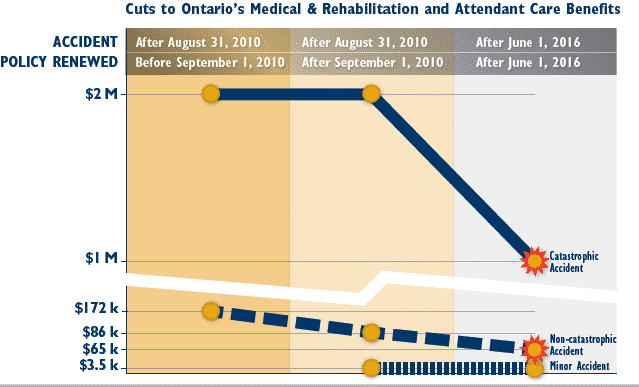

When you pay for car insurance, you are paying for peace of mind; if you or a member of your family are ever hurt in a car accident you believe you’ll have access to necessary treatment and care to help during the recovery process. But, the changes mandated by the Government of Ontario took the previous limits of $2 million for Medical & Rehabilitation and Attendant Care benefits available for individuals catastrophically injured in a car accident and slashed them in half, down to only $1 million. While the average driver may have seen premiums drop by a total of 10% over the past couple of years, $1 million in security is a lot to give up for the small savings. Meanwhile, for individuals with injuries that are not catastrophic, the Medical & Rehabilitation and Attendant Care benefits have also been combined and reduced from a total of $86,000 over 10 years, down to $65,000 over 5 years.

Meanwhile, for individuals with injuries that are not catastrophic, the Medical & Rehabilitation and Attendant Care benefits have also been combined and reduced from a total of $86,000 over 10 years, down to $65,000 over 5 years.

Cutting benefits and coverage means you and your family may not be able to receive the quality of care and treatment that you will need to recover, and to regain the quality of life you deserve

Unfortunately, lack of awareness means that most people in Ontario will not learn about these changes until they need to access the insurance benefits. And at that point, it will be too late to get additional coverage.

As a personal injury lawyer, the worst thing that you want to hear from a client is “I didn’t know … I didn’t know that I wasn’t covered.”

What can you do about it? Be proactive! Call your insurance company or broker to ensure you have coverage for Optional Benefits for Medical Rehabilitation & Attendant Care added back to your policy. For the cost of a few cups of coffee a month, you can make sure that you and your family are protected. This additional coverage is not expensive, and will give you back the benefits that are now being cut from the basic policy.

You have no choice but to carry insurance. You do have a choice to carry more insurance to close this new gap.

For your own peace of mind, don’t get caught without enough insurance.

Click to access a list of frequently asked questions on accident benefits changes.

Click to view the Statutory Accident Benefits Schedule [PDF], which includes these recent changes.

For more information about accident benefits changes, please contact Adam Wagman at adamwagman@hshlawyers.com or 416-361-0988.