As a part of the many auto insurance changes that will affect all Ontarians come June 1, 2016, a number of accident benefits that individuals have had available to them as a part of the basic coverage provided by insurers will no longer be available automatically.

The Statutory Accident Benefits Schedule (“SABS”) provides entitlement to benefits for people involved in motor vehicle accidents in Ontario. Regardless of whether or not the individual claiming benefits was at fault, and whether they are a driver, passenger or pedestrian, the SABS provides for certain specified benefits and amounts to be paid for specified periods of time.

Presently, the amount and duration of the payable benefit is determined by the level of injury sustained by the claimant; catastrophic (“CAT”), non-catastrophic and those which fall within the Minor Injury Guideline (“MIG”). The claimant may receive a number of benefits such as Medical and Rehabilitation expenses, Income Replacement for missing work, Non-Earner Benefits, Caregiver benefits, Attendant Care benefits and other benefits as a result of the accident.

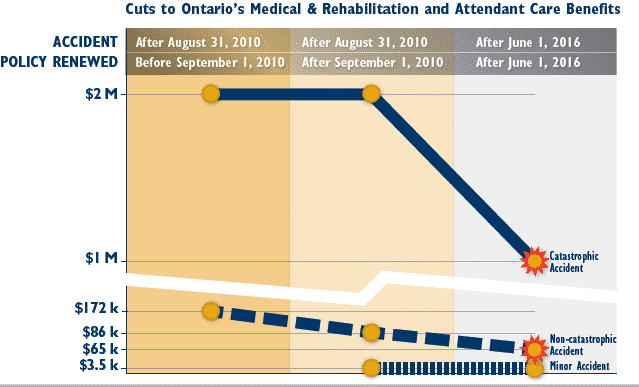

On June 1, 2016 there will be significant reductions in benefits to claimants. The most significant of these reductions will be in the areas of Medical and Rehabilitation and Attendant Care benefits for individuals with catastrophic and non-catastrophic injuries.

Individuals with catastrophic (spinal cord injury, amputations and brain injury for example) will no longer have access to $1,000,000 for Medical and Rehabilitation and $1,000,000 for Attendant Care benefits, for a total of $2,000,000. These victims have a genuine need for these benefits in order to carry on with their day to day activities, nevertheless they will have a reduced and combined amount of $1,000,000, for their lifetime.

Those suffering from non-catastrophic injuries will no longer have $50,000 for Medical and Rehabilitation and an additional $36,000 for Attendant Care benefits, for a combined total of $86,000. These victims’ benefits will be reduced to a combined amount of $65,000 for both Medical and Rehabilitation and Attendant Care benefits for a period of 5 years, as opposed to the previous 10 years for Medical and Rehabilitation benefits and 2 years for the Attendant Care benefits.

With respect to Non-earner benefits, under the current SABS, eligible claimants are paid $185.00 per week for a period of up to two years following the accident. There is a 6 month waiting period. The insured individual must suffer a complete inability to carry on a normal life in order to be eligible for this benefit. Two years after the accident, the individual may receive an increased amount of $320.00 per week, if they still qualify. After June 1, 2016, the waiting period of 6 months will be reduced to 4 weeks, but benefits will end after 2 years from the date of the accident.

With respect to Non-earner benefits, under the current SABS, eligible claimants are paid $185.00 per week for a period of up to two years following the accident. There is a 6 month waiting period. The insured individual must suffer a complete inability to carry on a normal life in order to be eligible for this benefit. Two years after the accident, the individual may receive an increased amount of $320.00 per week, if they still qualify. After June 1, 2016, the waiting period of 6 months will be reduced to 4 weeks, but benefits will end after 2 years from the date of the accident.

When dealing with catastrophic injuries, the new changes will radically affect the definition of catastrophic impairment. In defining catastrophic injuries, there are revised definitions and new testing criteria for traumatic brain injuries for adults and children, amputations, ambulatory mobility, loss of vision, and mental and behavioral impairments. There is a new process for determining catastrophic injuries by combining physical and mental as well as behavioral impairments. This new definition will also provide for designation of catastrophic impairment for children with traumatic brain injuries, automatically, in certain circumstances. How these changes will affect individuals remains to be seen and could be a hot topic for more litigation.

Individuals now have the option to purchase additional benefits to increase their coverages. For example the Medical and Rehabilitation and Attendant Care can be covered back to the $50,000 and $36,000 respectively, but the additional benefit will come at an additional cost. This is why it is imperative that individuals carefully review their insurance policies when it comes time for renewal and ensure that they give serious consideration to increasing their Medical and Rehabilitation benefits and consider their needs for Attendant Care benefit coverage.

By law, there is a minimum requirement of Third Party insurance coverage in Ontario of $200,000.00. Most drivers have at least $1,000.000.00 Third Party coverage. Consideration to increase Third-Party Liability Coverage is essential because if someone is involved in an accident, and they are found at-fault for the accident, the injured party can sue them for damages. If their insurance policy limits are not adequate to cover the damages, the injured party can pursue the at-fault individual personally for any assets or wages over their insurance coverage. As SABS are a credit towards tort damages, in the past, the higher SABS provided for lower damage awards. Now, with the lower SABS amount, there is more personal exposure. Increased Third Party coverage can help protect the at-fault individual’s personal assets. It is suggested that you should increase your Third Party coverage to at least $2,000,000.00. The increased premium cost can be minimal in comparison to the risk of personal exposure.

Based on all of these changes, the government has suggested that Ontarians will get increased savings with reduced insurance premiums. However, one must pay more now to get the same benefits which were provided to them at no additional cost before the new changes, and will have to pay more to increase their Third Party coverage to protect themselves. It is the opinion of most all in the know that the changes are detrimental to Ontario drivers and the promised reduced premiums will not compensate for the loss of coverage and benefits. It is imperative that all automobile owners call their brokers and/or insurers in order to purchase optional benefits and increase Third Party coverage to protect themselves and their loved ones.

Click to Download the 2016 Statutory Accident Benefits Summary [PDF].

For more information on this article or any Accident Benefit Claims generally, or more specifically related to the new changes, please contact Michael J. Henry at 416-361-0889, email at mjhenry@hshlawyers.com.