Is your insurance broker adequately inquiring about your insurance needs? With the substantial decline of available medical, rehabilitation and attendant care benefits from $2 million to $1 million for catastrophically injured individuals, this is a question that will be asked more often in the realm of motor vehicle insurance. The recent cutbacks to the accident benefits regime in Ontario are expected to have profound effects on those seriously injured in accidents.

The Courts have found that insurance brokers have a specialized knowledge and qualifications for assessing customers’ needs which is akin to a fiduciary relationship. Your broker must do more than just tell you what is available. They are required to ask their clients about all potential risk factors and fill in those gaps by offering the proper insurance that will cover those needs. This also includes a duty on the broker to ascertain information upon renewal of policies to ensure that their customers’ needs are continually being adequately met and that there has been no change of coverage needs since the issuance of the initial insurance policy.

In Ontario, there are two regimes for motor vehicle accidents; tort lawsuits, or third party liability coverage and statutory accident benefits also referred to as first party liability coverage.

For third party coverage, minimum liability limits in Ontario are $200,000, however, typical policies of insurance are written for $1 million. Brokers should be letting clients know that there is an option to increase these limits. This is important for two reasons. First, should you as a driver get into an accident and be the at fault driver, your coverage is only up to the limits that you have purchased. Should the injured party have claims above your coverage, you may be personally responsible for those claims above your limits. The second reason is, should you get in an accident yourself and the driver who is sued only has minimum limits, there is an option under the OPCF 44R endorsement on your policy to receive a top up between policies. If your limits are more than the at fault party’s, then you may claim up to the limits of your own policy.

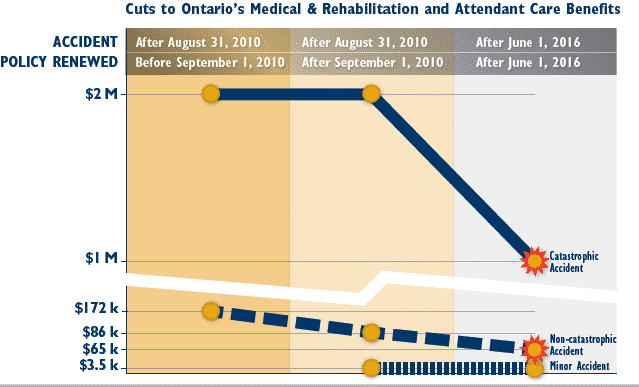

For accident benefit coverage, these benefits cover you should you be injured in an accident, regardless of fault. These types of benefits include income replacement, medical and rehabilitation expenses, as well as attendant care benefits, among others. These benefits have been significantly reduced for everyone. Below is a chart demonstrating the cuts to Ontario’s Accident Benefits regime:

It is important to note that there are optional benefits available to purchase, typically for a minimal increase in premiums. These are options that your broker must make you aware of when purchasing and renewing a policy of insurance. They must do more than simply state that they are available, they should make inquiries of your specific insurance needs and let you know what the potential risks are to you for not purchasing these enhanced benefits.

Click to view the new Statutory Accident Benefits Schedule [PDF], which includes these recent changes.

Has your broker covered these areas of need for you to determine you insurance needs? Have you been in an accident and found yourself without adequate coverage? Should you wish to inquire about a potential broker negligence claim, please contact personal injury lawyers Kaitlyn MacDonell at 647-260-4498 – kmacdonell@hshlawyers.com; or Michael J. Henry at 416-361-0889 – mjhenry@hshlawyers.com.