As a former nurse, I have had many occasions to observe patients and their loved ones experience the immediate aftermath of a devastating personal injury resulting from a motor vehicle collision. When the initial shock subsides, the practical questions begin to pour out: Who is going to pay for treatment and rehabilitation not covered by OHIP? What will we do about lost income during a recovery period? If ongoing attendant care or other types of assistance are required, will insurance cover it?

Navigating the terrain of accident benefits can be daunting for accident victims and their support networks. This blog post highlights some important changes to Ontario’s Statutory Accident Benefits Schedule (SABS) that came into effect June 2016.

Statutory Accident Benefits: Overview of Major Changes

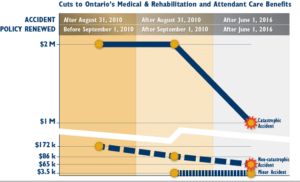

Personal injuries resulting from motor vehicle accidents are classified as minor, non-catastrophic, or catastrophic under the Statutory Accident Benefits Schedule (SABS). Benefits can vary significantly based on the assessed level of injury. However, changes to the benefits’ schedule have significantly reduced coverage for the most seriously injured accident victims.

These changes were introduced by the Ontario government in a bid to reduce insurance premiums and regulate the maximum benefits available to accident victims for accidents occurring after June 1, 2016 (and for policies renewed after this date). Let’s review.

Medical & Rehabilitation and Attendant Care

Prior to June 1, 2016, Medical & Rehabilitation and Attendant Care benefits were two separate categories. Under the new SABS:

- Persons with catastrophic injuries may be entitled to a maximum combined benefit of up to $1,000,000 over their lifetime (reduced from $2,000,000).

- Persons with non-catastrophic injuries may be entitled to a maximum combined benefit of up to $65,000 over 5 years (instead of $50,000 over 10 years for Medical Rehabilitation and $36,000 for Attendant Care over 2 years).

- Persons with minor injuries may be entitled to a maximum benefit of $3,500 (but the claim period has been reduced from 10 years to 5 years).

Examinations

Persons having suffered injuries in any category may also be entitled to claim up to a maximum of $2,000 for each medical assessment they require. The amount however is deducted from their Medical and Rehabilitation and Attendant Care benefit.

Optional Benefits and Increased Insurance Coverage

It’s important to remember that these benefits represent only the Statutory Accident Benefits Schedule available to motor vehicle accident victims in Ontario as of June 1, 2016. With these changes also came Optional Benefits for Medical & Rehabilitation and Attendant Care which you can purchase to increase coverage limits. You should contact your insurance agent or broker to discuss your current coverage and obtain advice on your optional benefits needs.

Click to view the Statutory Accident Benefits Schedule [PDF], which includes these recent changes.

For more information, please contact Renée Vinett at 416-361-7560, email at rvinett@hshlawyers.com.